Trigger Orders Now Live On HTX DM

- Anuncios importante

Dear valued users,

HTX DM has already launched Trigger order , by setting a trigger, it lets users place stop losses and take profits orders when there is high market volatility.

What is trigger order?

Trigger order is a pre-set order, that users place ahead with an order price and contracts amount (like a limit order), which will only be triggered under specific conditions (a trigger price/trigger). Once the latest traded price has reached the "trigger", the pre-set order will be executed. With this type of order, users don’t need to keep an eye on the market all the time, instead, they could set an order in advance to sell or buy contracts, which would help to take profits and stop losses.

Parameters Description:

Trigger price/Trigger: Once the latest traded price has reached the "trigger price"/” Trigger”, the pre-set order will be executed.

Order price: The price users enter to sell/buy contracts. Once the latest traded price has reached the "trigger price"/” Trigger”, the system will automatically place the order at the pre-set order price to order book.

Contracts Amount: The amount users enter to sell/buy contracts. Once the latest traded price has reached the "trigger price"/” Trigger”, the system will automatically place the order of this pre-set contracts amount to order book.

Example on APP

A user has 100 lots of BTC weekly contracts of short positions, with average open position price of 4,000 USD.

He thinks the key support will be near 6,000 USD; if the price can break through the support line, there will see great price increase. In order to stop losses, the user needs to close positions at price of 6000 USD via Trigger Order.

- Steps to operate:

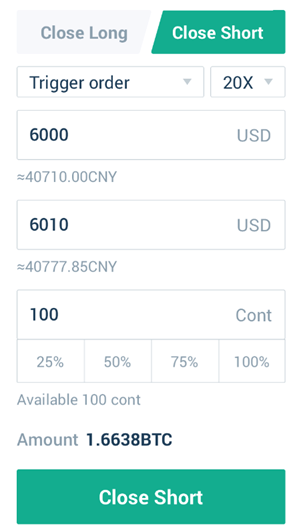

- Select “Trigger Order”;

- Set trigger price of 6000 USD, and plan to buy the 100-lot contracts (contracts amount) to close short at 6010 USD (order price).

After entering the quantity, click “close short” to place the order.

How to check the order status?

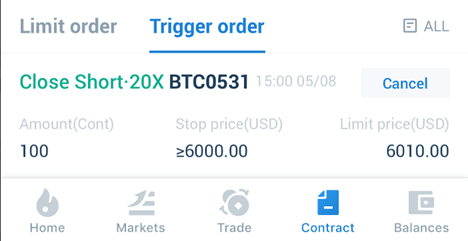

After setting and placing a trigger order, user can find the order under “Open Orders – Trigger Orders” to check the order status.

How to find history records of trigger orders?

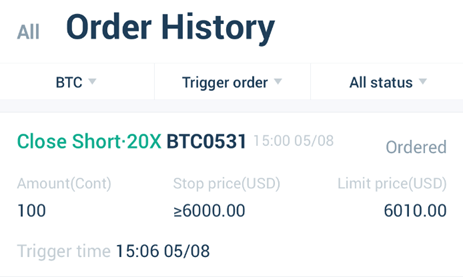

After getting triggered, the trigger orders can be found under “Order History – Trigger Orders”.

Example on Web:

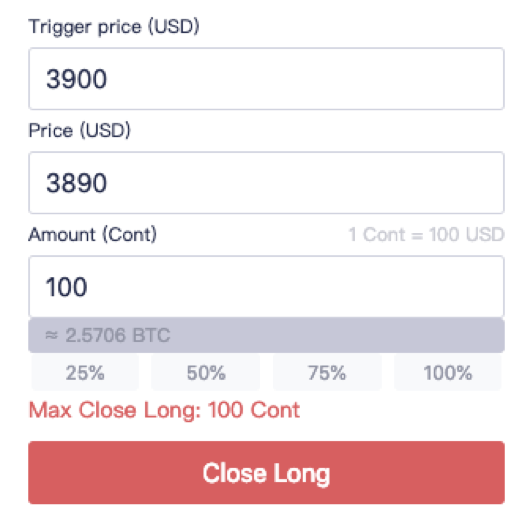

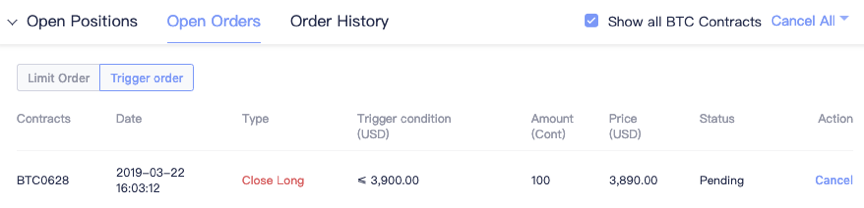

A user has 100 lots of BTC quarterly contracts of long positions, with average open position price of 4,000 USD. He thinks the key support will be near 3,900 USD; if the price falls below 3,900 USD, there will be a large drop. In order to stop losses, the user needs to close positions at price of 3,890 USD via Trigger Order. He sets a trigger price of 3,900 USD, and plan to sell the 100 lots of contracts to close long (contracts amount) at 3,890 USD (order price), after entering the numbers, he clicks “sell to close long” to place the order.

How to check the order status?

After setting and placing a trigger order, user can find the order under “Open Orders – Trigger Orders” to check the order status.

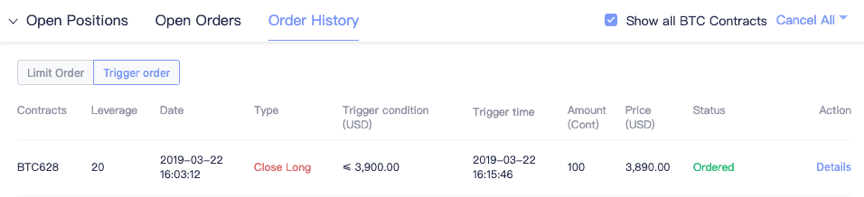

How to find history records of trigger orders?

After getting triggered, the trigger orders can be found under “Order History – Trigger Orders”.

Note:

1.Users can not place trigger orders when that types of contracts are in delivery, settlement or suspension status, which means trigger order function is only available for trading-status contracts.

2.There is order limit for trigger orders. Users cannot place trigger orders for one type of contract when surpassing order limit of that type of contract.

3.Once the latest traded price has reached the "trigger", the pre-set order will be executed. But if the pre-set order price is not within the price limit (i.e. users set a ask price that is higher than the highest ask price or a bid price that is lower than the lowest price), then, the trigger order will fail.

4.For the last 10 minutes before delivery, users can only place trigger orders to close positions but not open positions; trigger orders that has been triggered during the last 10 minutes before delivery may fail to place order to order book.

5.Trigger order may fail to be placed due to price limit, position limit, lack of margin, contracts in not-allowed-trading-status, network issues, system issues, etc...

6.Before the order getting triggered, the margin or positions will not be frozen till the trigger order gets triggered opening/closing positions at pre-set order price and amount.

7.After getting triggered, the trigger order will be placed to order book at pre-set price, whether it successfully filled or not depends on the market.

Thanks for your support. We assure you of our best service.

HTX Derivative Market

March 29, 2019

join in us

WeChat:dm18125 ,dm18123 ,dm18122 ,dm18121

QQ Group:936093939

Telegram:https://t.me/huobidmofficial