“Trigger Order” Function Introduction

- Guide de Trading Spot

Dear Users,

HTX has now launched the function of “Trigger Order” and invite you to experience it!

Trigger Order means that when the latest market transaction price reaches the trigger conditions, the system will place orders according to the pre-set price and quantity set in advance.

The features of Trigger Order are as follows:

1. The “Trigger Order” order function now is available in the spot and margin trading section (not apply to “Quick Margin” at the moment), and it applies to two types of orders, limit and market. The order quantity and price must follow the existing trading restrictions.

2. The assets corresponding to the order will not be blocked before the Trigger Order is conducted. After the Trigger Order is conducted (when placing an order to buy or sell according to the pre-set price and quantity), the assets corresponding to the order will be blocked.

3. The Trigger Order may not necessarily be triggered. Affected by factors such as price restrictions, account balances, trading pair delisting, network abnormalities or system upgrades, the Trigger Order may fail to be triggered.

4. The transaction may not necessarily be completed after the Trigger Order is triggered. Affected by market conditions, when the market fluctuates greatly and the price rises or falls sharply, the limit order or market order after the Trigger Order is triggered may not necessarily be traded.

(1) The limit order that is successfully triggered by the Trigger Order is the same as the ordinary limit order and the order is placed at the order price set by the user in advance. The so-called limit order means that when the price of the pending to sell is lower than the current market price, it will be traded at the market price. When the price of a pending order to buy is higher than the current market price, it will be executed at the market price. The order cannot be guaranteed to be filled and it depends entirely on the current market conditions.

(2) The market order that is successfully triggered by the Trigger Order is the same as the ordinary market order. It is bought or sold at the current market price according to the buying amount or selling quantity set by the user in advance. The order cannot be guaranteed to be filled and it depends entirely on the current market conditions.

Terms description:

Trigger price: When the latest transaction price reaches the set trigger price, the order will be triggered to be placed.

Order price: Namely the buying price and the selling price. When the latest price reaches the trigger price, the system automatically orders the order price. If you select the limit order, the system will automatically place an order at the buy/sell price you set. If you choose the market price, the system will automatically place the order at the market price when it is triggered.

Quantity: it means the “order quantity” after the Trigger Order is triggered. If you select the limit order, the quantity is the buy/sell quantity you set. If you select the market order, it is the total amount you set when you buy and the total selling quantity you set when selling.

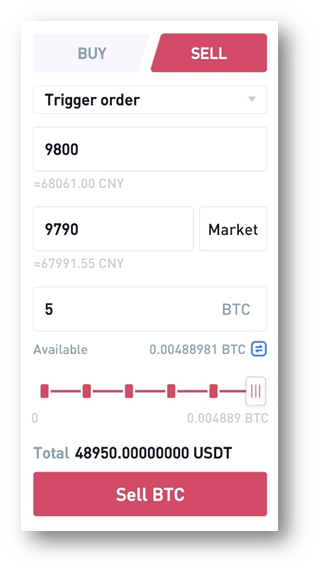

APP demonstration:

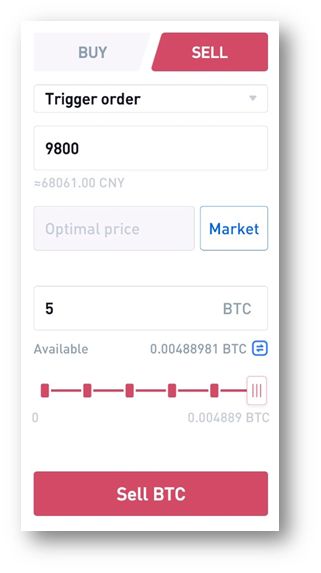

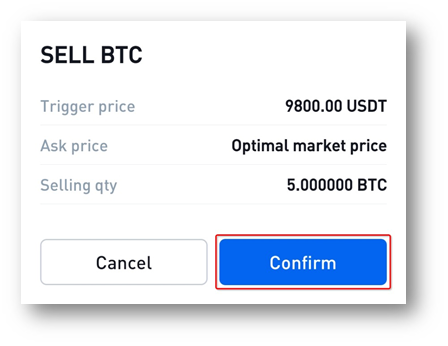

A user holds 5 BTC spot, with an average price of 10,000 USDT each. The user believes that around 9800 is an important support level. If the price breaks the support level, there will be a big drop. In order to avoid large losses, it is necessary to set a Trigger Order for stop loss and liquidation.

1.1 Specific operation method:

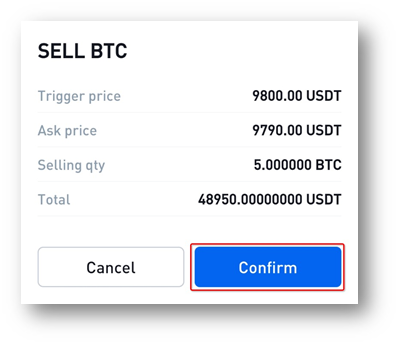

Order placement method 1: Select “Trigger Order”, set the trigger price of 9800 USDT, the selling price of 9790, the order quantity is 5 BTC and click the “Sell” button to complete the order.

Order placement method 2: Select “Trigger Order”, set the trigger price of 9800 USDT, select “Market”, enter the quantity, and click the “Sell” button to complete the order. When the latest trading price reaches 9800 USDT, the Trigger Order will be triggered, and it will be quickly sold at the current market price to avoid missing the market.

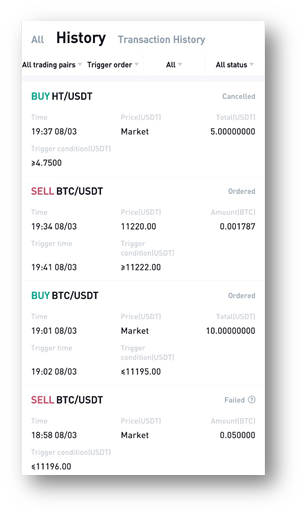

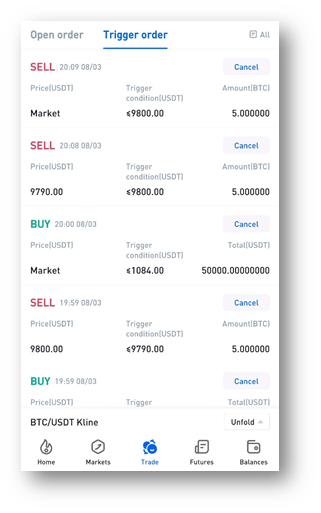

1.2 Order view

View untriggered Trigger Orders: After the order is successfully placed, you can view the order in “Trigger Order”, and you can cancel the Trigger Order before it is triggered.

View completed Trigger Orders: After the order is successfully triggered, you can view the historical order records in the “Trigger Order” record in “History”. Cancelled orders and orders that failed to be triggered can be viewed in “History”. For orders that have failed to be triggered, you can click the  of the failed trigger to view the reason for the failure.

of the failed trigger to view the reason for the failure.

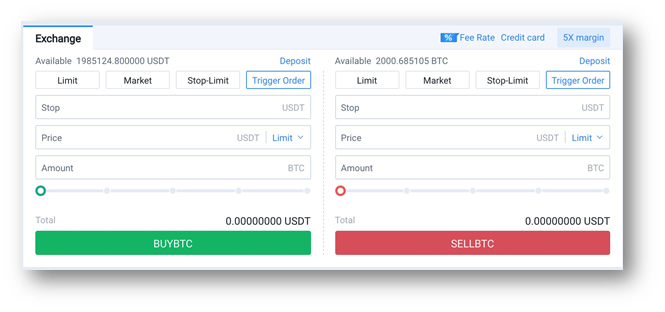

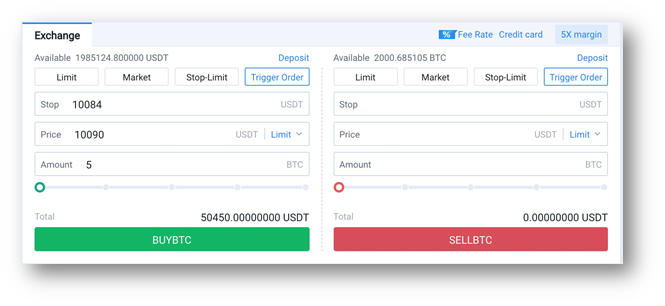

WEB demonstration:

A user wants to buy BTC at a suitable point. The user believes that around 10084 USDT is an important resistance level. If the price breaks through the resistance level, there will be a large increase. In order not to miss the market, it is necessary to set up a Trigger Order to chase the increase.

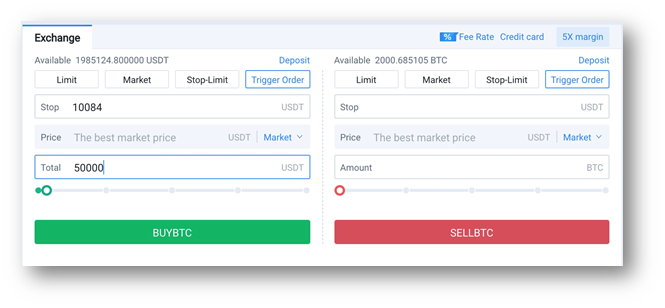

2.1 Specific operation method:

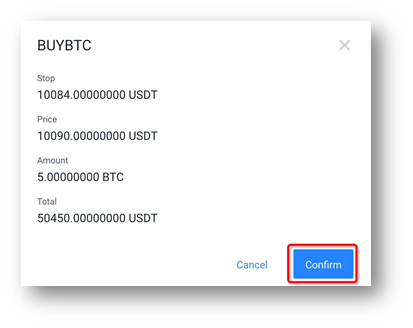

Order placement method 1: Select “Trigger Order”, set trigger price as 10084 USDT, buy price 10090, order quantity 5 BTC, click the “Buy BTC” button to complete the order.

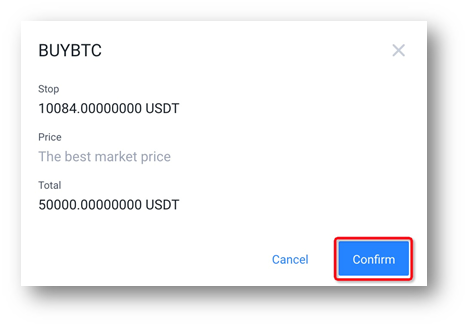

Order placement method 2: Select “Trigger Order”, set the trigger price as 10084 USDT, select “Market”, enter the trading amount, and click the “Buy” button to complete the order. When the latest trading price reaches 10084 USDT, the Trigger Order will be triggered, and the purchase will be made quickly at the current market price to avoid missing the market.

2.2 Order view

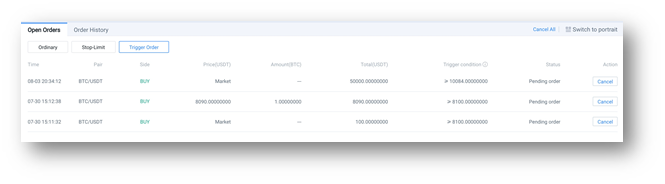

View untriggered Trigger Orders: After the order is successfully placed, you can view the order in “Trigger Order”, and you can cancel the Trigger Order before it is triggered.

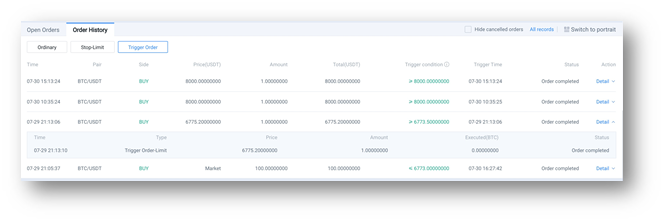

View completed Trigger Orders: After the order is successfully triggered, you can view the historical order records in the “Trigger Order” record in “Order History”. Cancelled orders and orders that have failed to be triggered can be viewed in the “Order History”. For orders that have failed to be triggered, you can click “Details” to view the reason for the failure.

Thank you for your support to HTX. We will continue to provide you with a more convenient experience and better service!