Limit Order Operation Instruction(Web)

- Coin-M Perpetual Guides

- Limit order

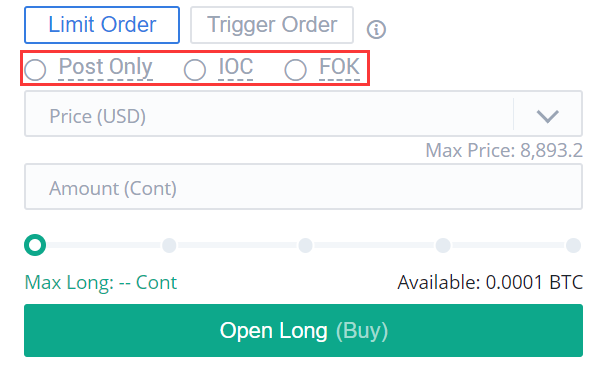

Limit order: The user needs to specify the price and quantity of the order. The limit order specifies the highest price that users are willing to buy or the lowest price that they are willing to sell. After the user sets the limit price, the market will prioritize the transaction at a price that is favorable to the user. Limit orders can be used to open and close positions. The unfilled part is automatically converted into a pending order and waiting for a deal. The limit order can choose three effective mechanisms, "Post only", "FOK (Fill Or Kill)", "IOC (Immediate Or Cancel)"; when no effective mechanism is selected, the limit order defaults to "always valid".

Post only orders will not be immediately traded on the market. If the order is immediately concluded with an existing order, the order will be cancelled to ensure that the user is always Maker.

IOC orders, if it cannot be immediately traded in the market, the untranslated part will be cancelled immediately.

FOK orders, if not all orders can be traded,then system will be cancelled all orders immediately.

For example:

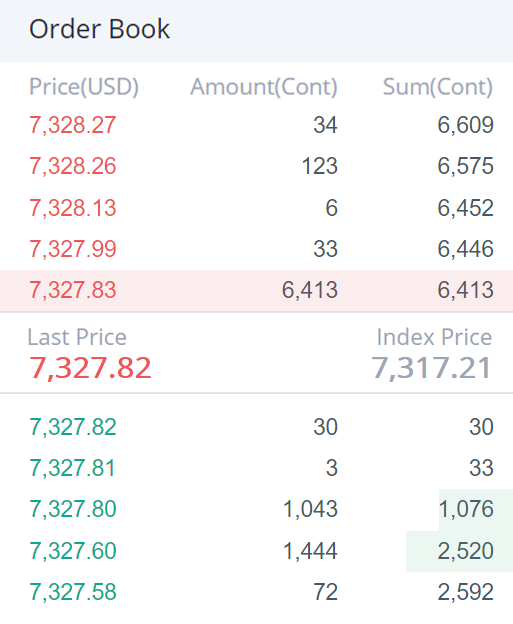

A user wants to carry out BTC perpetual swaps transactions. The following is the market data of a BTC perpetual swaps at a certain moment:

- Assume that the user has not selected the effective mechanism and entered a commission price of 7327.85 USD to buy 1,000-lots of contracts. At this time, the user's order will be immediately filled with the market's best price of 7327.83;If the user enter a commission price of 7327.81USD and selling to open 1,000-lots short contracts, the matching system will immediately trade 33 pieces at the market's best price, and the rest will be hung on the market.

- If the user wants to enjoy the maker rate, he can select “Post only” to place an order. If the buy price is 7327.70 USD, the order will not be immediately traded on the market, the pending order will be successful; If the buy price is 7279.90 USD, it will be immediately traded with the sell 1 price of the commission queue, and the order will be cancelled;

- If the user selects "IOC (Immediately or Cancel)", the buy price is 7350.00 USD, the amount of buy orders is 7000 conts, and the total number of all current sell orders is 6,609 conts. After all sell orders are completed, there are 7000-6609 = 391 unsettled conts, Then 6,609 conts will be sold, and the remaining 391 conts will be cancelled immediately;

- If the user selects "FOK (Fill or Kill)" to place an order, the buy price is 7350.00 USD, and the amount of buy orders is 7000 conts. At present, the total amount of all sell orders is only 6609 cont, which is not enough to make all the orders filled. It will cancel all orders; if the user orders 6,000 conts, the order will be completed.

Note:

- The buying price cannot be higher than the current "highest buying price", and the selling price cannot be lower than the current "lowest selling price".

- Opening a limit order will take up margin, and closing a limit order will take up positions.

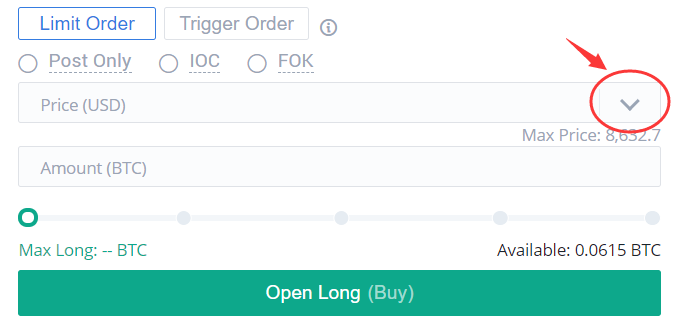

- The Optimal Top N BBO Price Order:

By The Optimal Top N BBO Price Order function, it means that users can place orders based on BBO price, which users can place order faster and get it fulfilled immediately only by selecting desired price level among “top 5 optimal BBO price”, “top 10 optimal BBO price” or “top 20 optimal BBO price” and enter contract quantity. No need to take the trouble judging and entering order price. The Optimal Top N BBO Price Order function is available for both opening and closing position in both limit order and trigger order, enabling faster transaction and helping user seize potential big market move.

Note:

When the margin ratio of the user's position is low or the market volatility is large, if the system determines that The Optimal Top N BBO Price of the opponent's market will cause the user to close the position, the margin ratio will be less than 0. The Optimal Top N BBO Price order will be invalid (that is, unavailable).

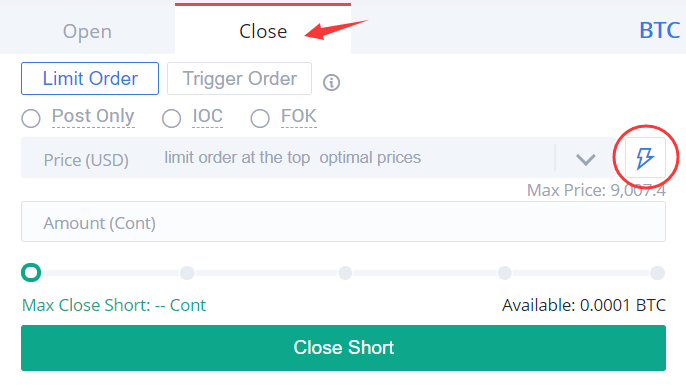

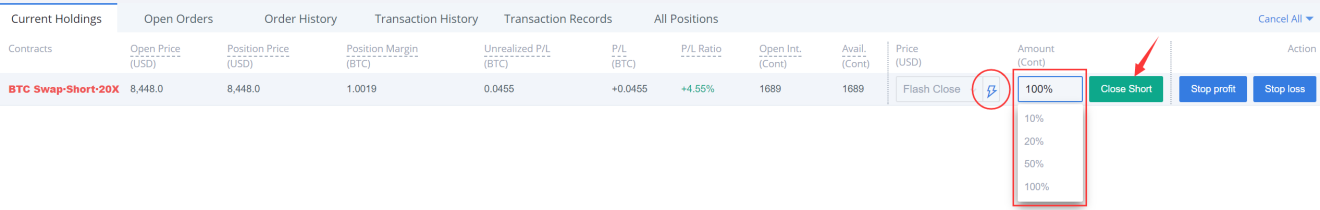

- Flash close

Flash Close is a function that would help users to place orders with top 30 optimal prices based on the BBO price orders. In other words, users could close positions with top 30 optimal BBO prices as fast as possible. However, if there are positions left not closing, the unfilled parts will convert to Limit Order automatically. The close prices of Flash Close are predictable, avoiding the losses caused by unfilled orders when market moves violently.

Operation:

Method 1. Scroll down to “Close” area, choose “Flash Close”, enter the number of closing positions and click “Close short/long” to place the order.

Method 2. Scroll down to the “Open Positions” area, choose “Flash Close”, enter the number of closing positions and click “Close short/long” to place the order.

Note:

If system tells that top 30 optimal prices can't fulfill the condition of magin rate greater than zero after the position closing due to violent market or low margin rate, flash close would fail.