Partial Liquidation

- Hướng dẫn Coin-M Vĩnh cửu

What is liquidation?

Margin ratio is an indicator used to estimate the users’ assets risk. When margin ratio less than or equal to 0%, forced liquidation will be triggered.

Margin Ratio = ( Account Equity / Used Margin ) * 100% – Adjustment Factor

Note: Used Margin = Position Margin + Frozen Margin

HTX Futures implement tiered liquidation,That is, the system will try to reduce the gear corresponding to the Adjustment Factors, so as to avoid the position being liquidated all at once.

IF the liquidation is trigged when the gear corresponding to the Adjustment Factors is 1st level:

- The system will cancel all current orders for this symbol contract;

- The long and short positions of the contract of the same symbol will be self-traded;

- If the margin ratio of the user's position is still less than 0 at this time, it will be it will be liquidated at once time.

IF the liquidation is trigged when the gear corresponding to the Adjustment Factors is more than 1st level:

- The system will cancel all current orders for this symbol contract;

- The long and short positions of the contract of the same symbol will be self-traded;

- If the margin ratio is still less than 0, the system will reduce the adjustment factor for the purpose of forcibly reducing the position to the upper limit of the net position of a certain position, and the margin rate is more than 0;

- If the margin reduction is forced to the 1st level and the margin ratio is still not more than 0, then all remaining positions will be liquidated at once time.

There is no charge for partial liquidation.Users cannot perform operations related to this type of contract when the forced liquidation is triggered.

What’s adjustment factor?

The adjustment factor is designed to prevent users from losing margin calls on the system. HTX Futures uses a layered adjustment factor mechanism, which supports up to five levels most depending on the currency. When the user's net position is high, he / she will be in a higher adjustment factor coefficient and has a higher risk.

Example:

Taking the adjustment factors of BTC contract as an example. According to the table below, if a user has 1000 lots of BTC contracts in open interest, Corresponds to the 2nd level. The adjustment factor for 10 leverage multiple, 20 leverage multiple and 5 leverage multiple is 10%, 20% and 5% correspondingly.

[searching adjustment factor of more trading pairs]

[The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice.]

What is Estimated Liquidation Price?

The estimated Liquidation Price is the estimated market price when the margin ratio is equal to or less than 0%. Please note that this price is for reference only. The real-time liquidation price should refer to the last order price when the margin ratio less than or equal to 0%.

What’s Mark Price?

To reduce unnecessary liquidations, the system uses mark price as another reference price for liquidation of coin-margined swaps. That is, when the system is to trigger a liquidation, it must satisfy that the margin ratios calculated both by using the latest price and by using mark price are less than or equal to 0%. Using mark price for calculation can avoid the risk of liquidation or serial liquidation caused by several abnormal prices as much as possible.

Mark Price Calculation

- Funding rate basis fair price

The funding rate basis fair price is a relatively reasonable reference price for the perpetual swaps, which is calculated based on the current spot index price and the current funding rate basis rate.

Funding Rate Basis Fair Price = Index Price * (1 + Funding Rate Basis Rate)

- Funding Rate Basis Rate = Current-period Funding Rate * (Time Interval from Current Time to Current-period Settlement Time / Settlement Cycle)

For instance, if the current index price of BTC coin-margined swaps is 10,000USD, current-period funding rate is 0.01%, the current time is 12:00, and the current-period settlement time is 16:00, meaning there are 4 hours to the settlement, and the settlement cycle is 8 hours (settled every 8 hours), then the current funding rate basis fair price = 10000 * (1+ (0.01% * 4 / 8 ) ) = 10000.5 USD.

- Depth weighted fair price

The depth weighted fair price is a relatively reasonable reference price related to the current order book depth, which is calculated based on the current spot index price and EMA depth weighted middle price basis.

Depth Weighted Fair Price = Index Price+ EMA (Depth Weighted Middle Price Basis)

- EMA (Depth Weighted Middle Price Basis) = (Current EMA Calculated– last EMA Calculated) * Factor + Last EMA Calculated;

- Depth Weighted Middle Price Basis = (Depth Weighted Bid Price + Depth Weighted Ask Price) /2 –Index Price;

- The depth weighted bid price refers to the average bid price when the cumulative amount of open orders from bid_one reaches N conts based on the open orders on current order book. The depth weighted bid price = the average bid price of N conts;

- The depth weighted ask price refers to the average ask price when the cumulative amount of open orders from ask_one reaches N conts based on the open orders on current order book. The depth weighted ask price = the average ask price of N conts.

Note: For the value range of N, please refer to the below chart.

- Latest EMA

Latest EMA refers to the exponential moving average value of the latest transaction price of current coin-margined swaps.

Current Latest EMA = (Latest Price – Last EMA Calculated) * Factor + Last EMA Calculated

- The factor = 1 / 3;

To calculate current EMA, Pn represents the latest price of No. n

Assume P1 = 10000;P2 = 10006;P3 = 10011;then,

(1) EMA1 = P1 = 10000;

(2) EMA2 = ( P2 – EMA1 ) * Factor + EMA1 = ( 10006 – 10000 ) * 1 / 3 + 10000 = 10002;

(3) EMA3 = ( P3 – EMA2 ) * Factor + EMA2 = ( 10011 – 10002 ) * 1 / 3 + 10002 = 10005;

……

The above EMA will be calculated every 5 seconds, and the system takes the median value of funding rate basis fair price, depth weighted fair price and latest EMA as the mark price. The formula is as follows:

Mark Price = Median (Funding Rate Basis Fair Price,Depth Weighted Fair Price,Latest EMA)

To avoid unnecessary liquidations caused by abnormal mark price, when mark price sharply deviates from the contract price, the system will adjust the mark price accordingly; When mark price exceeds the upper and lower limits of deviation from the latest contract price, only the boundary value will be taken.

Mark Price = Clamp (Mark Price, Latest Price * (1 + Upper Limit of Deviation Factor), Latest Price * (1 – Lower Limit of Deviation Factor))

Currently, only some of the swaps calculate the mark price by using the median, while the others adopt “Mark Price = Latest EMA” to calculate. Details are as follows:

[ The above data and indicator contents may be adjusted in real time according to market conditions, and the adjustments will be made without further notice. ]

What is liquidation order price?

The liquidation price is the market price for reference when the margin ratio is equal to or less than 0%. When the margin ratio reaches to or below 0%, liquidation will be triggered and the trading system will take over the positions with a limit order price. Since the taken-over positions won’t go through the match system, the price of the taken-over positions will not display on the market (K-line chart). Please note that the liquidation order price is different from the liquidation price. For liquidation order details, you can go to HTX APP and click [ ? ] or go to web page and click “Details” in “Order History”.

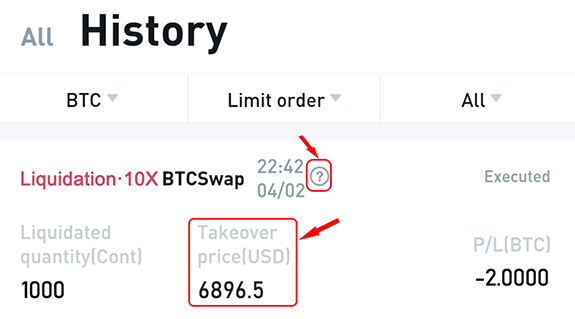

Example on APP:

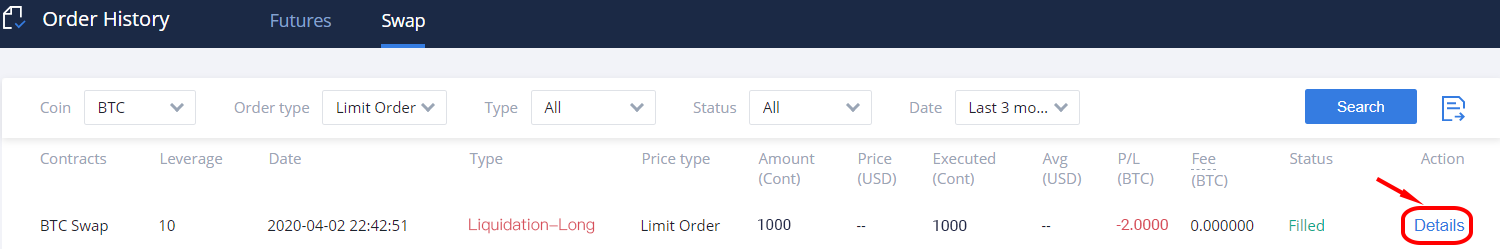

Example on web page:

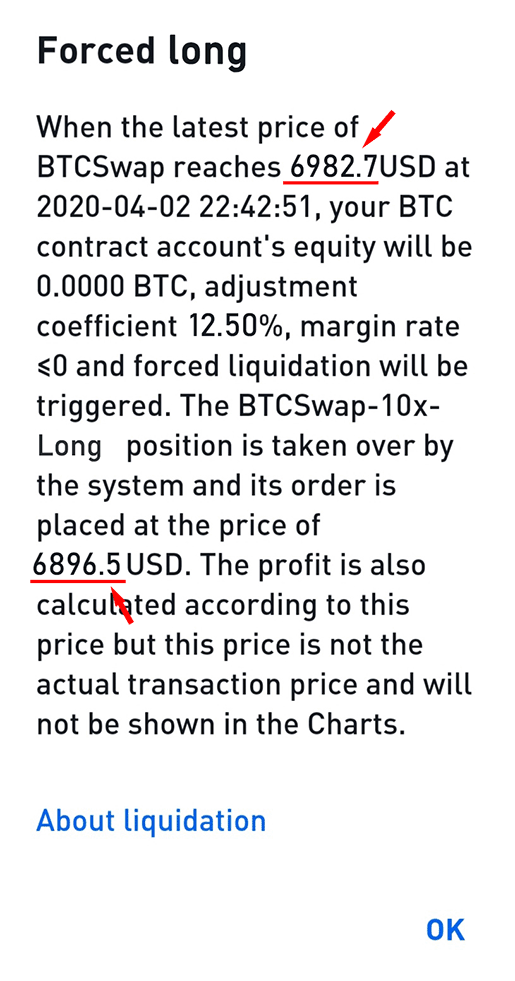

Details of liquidated orders:

Examples on the concept above:

Xiao Ming has 20 BTC in account equity. He opened long 15000-lot BTC swap contract at the price of 8000USD/BTC(100USD/lot). Assuming there was 10X in leverage, 15% in adjustment factor, the corresponding gear is the 3rd level. Do not corresponding transaction fees as well, what will happen to Xiao Ming’s positions when the last BTC swap contract reaches 7337.3 USD?

Let’s have a look the calculation for different elements.

1.Unrealized Profit and Losses

- According to the order direction-open long, the formula is Unrealized P/L for long position= ( 1 / Position Price – 1 / last order price ) * order quantity * contract face value

- Therefore, the calculation for Xiao Ming’s Unrealized P/L is: ( 1 / 8000 – 1 / 7,337.3 ) * 15000 * 100 = –16.9348BTC

- In this case, when the price of BTC swap contract reaches 7330.12 USD, Xiao Ming’s unrealized profit and losses is –16.9348BTC

2.Xiao Ming’s account equity

- Formula: Equity = Deposit + realized profits / losses + unrealized profits / losses

- Xiao Ming’s equity is 20 + 0 + ( –16.9348 BTC ) = 3.0652BTC

- Therefore, when the price of BTC swap contract reaches 7337.3 USD, Xiao Ming’s account equity is 3.0652BTC.

3.Position Margin

- Formula: Position Margin = ( Contract Value * Position Quantity ) / Last Order Price / Leverage

- Xiao Ming’s position Margin is ( 100 * 15000 ) / 7,337.3 / 10 = 20.4434BTC

- Therefore, when price of BTC swap contract reaches 7330.12, Xiao Ming’s current position margin is 20.4434BTC

4.Is liquidation triggered?

- Formula: Margin Ratio = (Account Equity / Used Margin ) * 100% – Adjustment Factor

- Xiao Ming’s margin ratio is ( 3.0652 / 20.4434 ) * 100% – 15% = 0%

- In this case, the EMA price according the EMA formula is 7337.3

- As explained above, when the margin ratios calculated according to both the last price and the EMA go to or below 0, Xiao Ming’s order will be liquidated

- Therefore, Xiao Ming’s order is liquidated when the price of BTC swap contract reaches 7337.3 USD

5.What will happen after liquidation?

- After the liquidation triggered, the system detects that Xiao Ming's net position is 15,000 and the scale corresponding to the adjustment factor is the 3rd gear. Then the system will try to recalculate Xiaoming's margin rate using the maximum value of the 2nd gear of 9999 sheets as the remaining position amount and the corresponding adjustment factor of 12.5%;

- Position Margin = ( 100 * 9999 ) / 7,337.3 / 10 = 13.6276BTC

- Realized profits / losses of positions that be takeovered:( 1 / 8000 – 1 / 7228.9 ) * ( 15000 – 9999 )* 100 = –6.6681BTC

- Unrealized profits / losses of positions that not be takeovered:( 1 / 8000 – 1 / 7,337.3 ) * 9999 * 100 = –11.2887BTC

- Account equity = 20 + ( – 6.6681 ) + ( – 11.2887 ) = 2.0432 BTC

- Therefore, if Xiao Ming only holds 9999 BTC contracts, the margin ratio of his position = ( 2.0432 / 13.6276 ) * 100% – 12.5% > 0%

- At this time, the system will taken over more than 15000 – 9999 = 5001 contracts beyond the second level by the system at the takeover price, it means that the releases partial liquidation of Xiao Ming's partial liquidation.

6.How about the Liquidation Orders Price(Takeover Price)?

- As mentioned above, when liquidation is triggered, the trading system will take over the order with a limit order price when the account equity goes to 0, Let us calculate the liquidation order price(takeover price). At first we set the liquidated price to x, and then set the specific value to see:

- Because ( 1 / 8000 – 1 / x ) * 15000 * 100 = –20 BTC

- So x = 7228.9

- That the price is 7228.9 USD when Xiaoming's account equity is 0. At the same time, this price is also the price at which the system takes over Xiao Ming's 5001 positions. The liquidation order price will not be displayed on the K-line;

- After the tiered force liquidation, Xiao Ming's remaining position is 9999 BTC swap contracts, and relevant operation authority will be restored.

(The above is a reasonable example use, the specific settings or related migration are subject to the platform announcement)

Insurance fund

Insurance fund is set up to cover the societal losses (i.e. losses attributed to unfilled liquidation order) or to settle incidents in contracts trading.

For each digital asset contract, there is a corresponding insurance fund, and the same digital asset contracts of different periods share one insurance fund.

The sources of insurance fund are mainly from HTX Futures and the premiums after forced liquidations. Once forced liquidation triggered, the system would take over users’ positions and close them by placing orders on order book. The premiums generated by liquidated positions will be injected into corresponding insurance fund. In terms of initial trade or under special situations, system will manually transfer the premiums (generated by liquidated positions) into exchange account, supplementing insurance fund.

A small percentage of fees may be charged when the system takes over users’ positions and implements the liquidation.

Use of insurance fund: During the settlement period of each cycle, if there were margin call losses attributed to unfilled liquidation order, system would first use insurance fund to meet the losses. Clawback will only occur if the insurance fund is not enough to cover the system's total margin call losses.

Clawback

When the market fluctuates severely, the user is subjected to liquidation, and the transaction cannot be concluded at the liquidation price, resulting in loss greater than the margin, the platform will adopt the “clawback” system. Clawback will only occur if the insurance fund does not have enough funds to cover the system's total margin call losses.

Full account clawback system

The system's total margin call losses

If system's losses + insurance fund >= 0, then clawback rate = 0

If system's losses + insurance fund < 0, then clawback rate = (system losses + insurance fund) / net profit across all contracts

Clawback coefficient = System's losses / Profit across all contracts

For example:

At the time of settlement, the BTC perpetual swaps had a totally loss of -120 BTC.

First fill it with risk reserves, if there is still a loss of -20BTC after filling. It needs to be allocated from the BTC contract profit account.

Assuming all the profits of the profitable account are 400000BTC, the allocation factor is 20/400000 = 1/20000

The perpetual swaps of an account made a total profit of 2BTC in this period, the amount to be allocated for this account is 2 * (1/20000) = 0.0001BTC.